Comply with Crowded

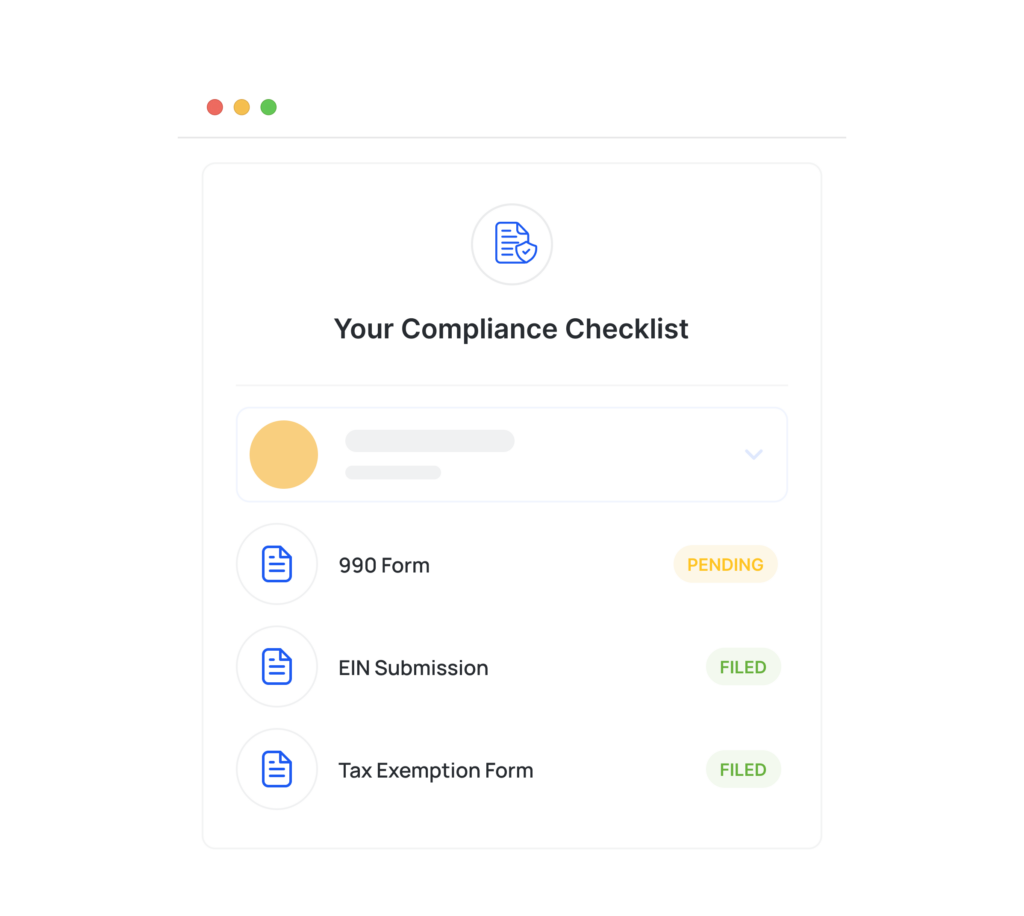

Stay tax compliant at every stage of your nonprofit journey

Compliance services for new nonprofits, multi-chapter nonprofits, and regular nonprofits needing to maintain their tax-exempt status.

- ✨ AI-generated annual 990 Forms

- State sales tax redemption - get up to 10% back!

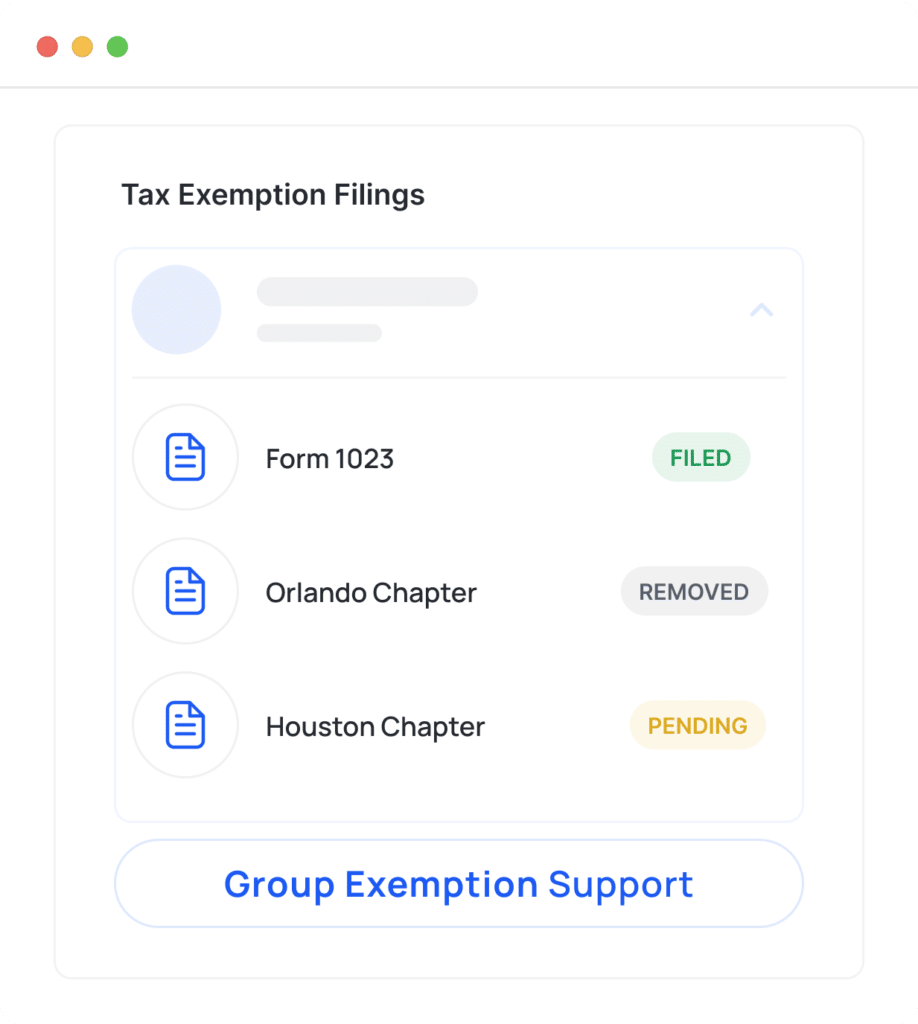

- Group exemption management for multi-chapter orgs

- EIN issuance & incorporation services

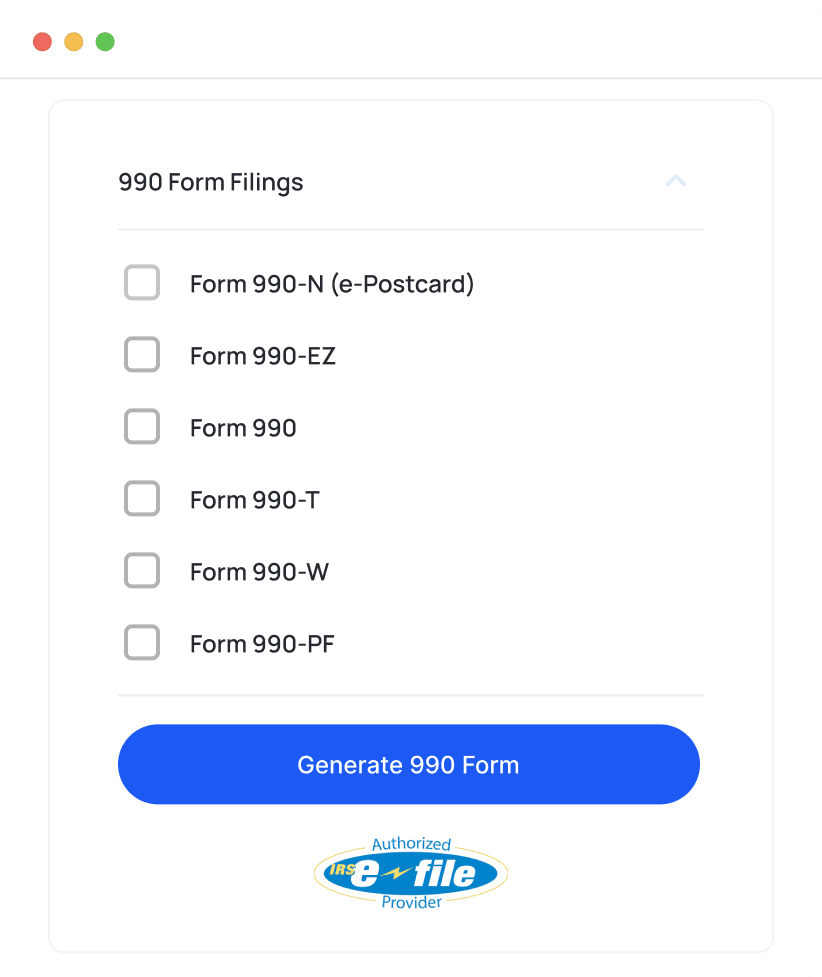

990 form filing

✨ AI-powered Form 990s

- Auto-populated form filings with AI trained on publicly available IRS data & Crowded banking data

- AI-powered 990 Form type selector

- E-filing certified with the IRS

Which Form 990 should my nonprofit file?

Your nonprofit should file...

0

Sent!

We’ll reach out shortly about pricing and timelines, so keep an eye on your inbox.

In the meantime, take a look at our bank accounts that keep nonprofits tax compliant all year long.

Please leave your contact details and we will be in touch about managing your 990 filing.

tax exempt

Stay tax exempt org-wide with group exemption services:

- Tax exemption applications for defunct chapters- Form 1023, 1023 EZ or 1024

- Annual group exemption reporting to the IRS

- Easily track crucial information on your active or defunct subsidiary chapters.

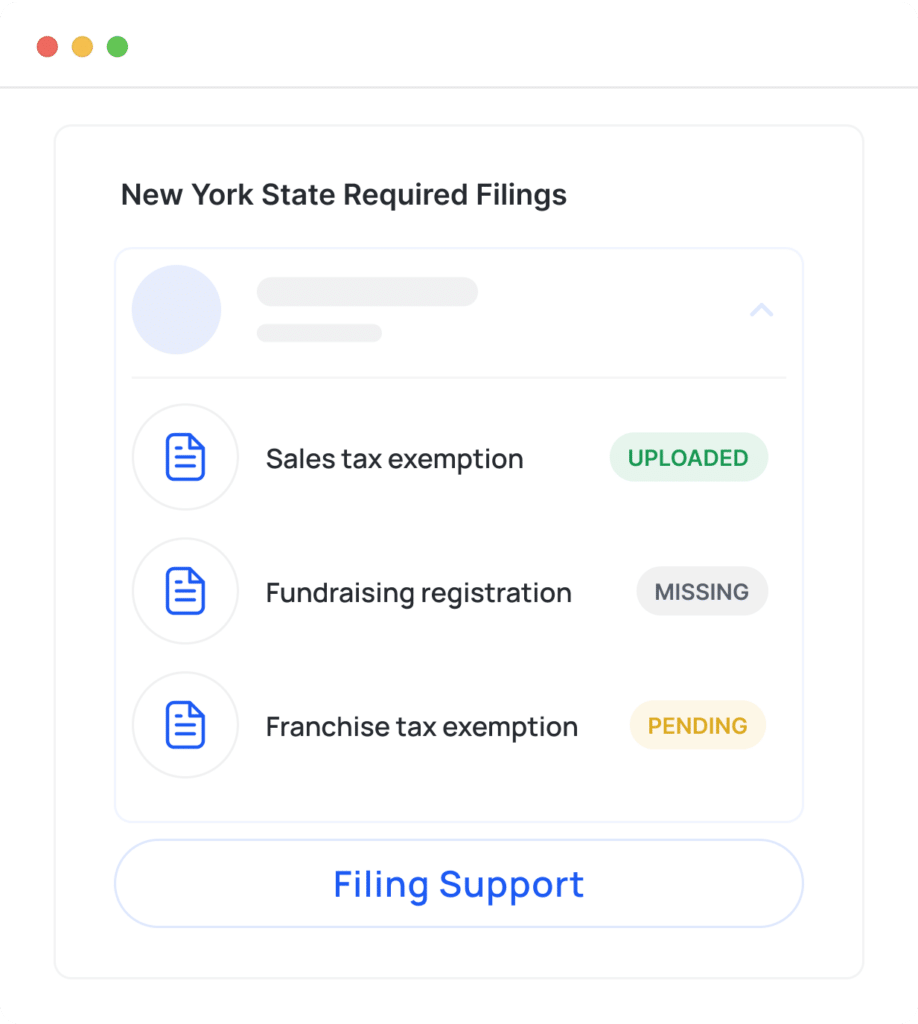

state level compliance

Comply with state level nonprofit requirements

- Income and/or franchise tax filing - if applicable

- Fundraising registration and renewal - if applicable

- Sales tax recovery - if applicable

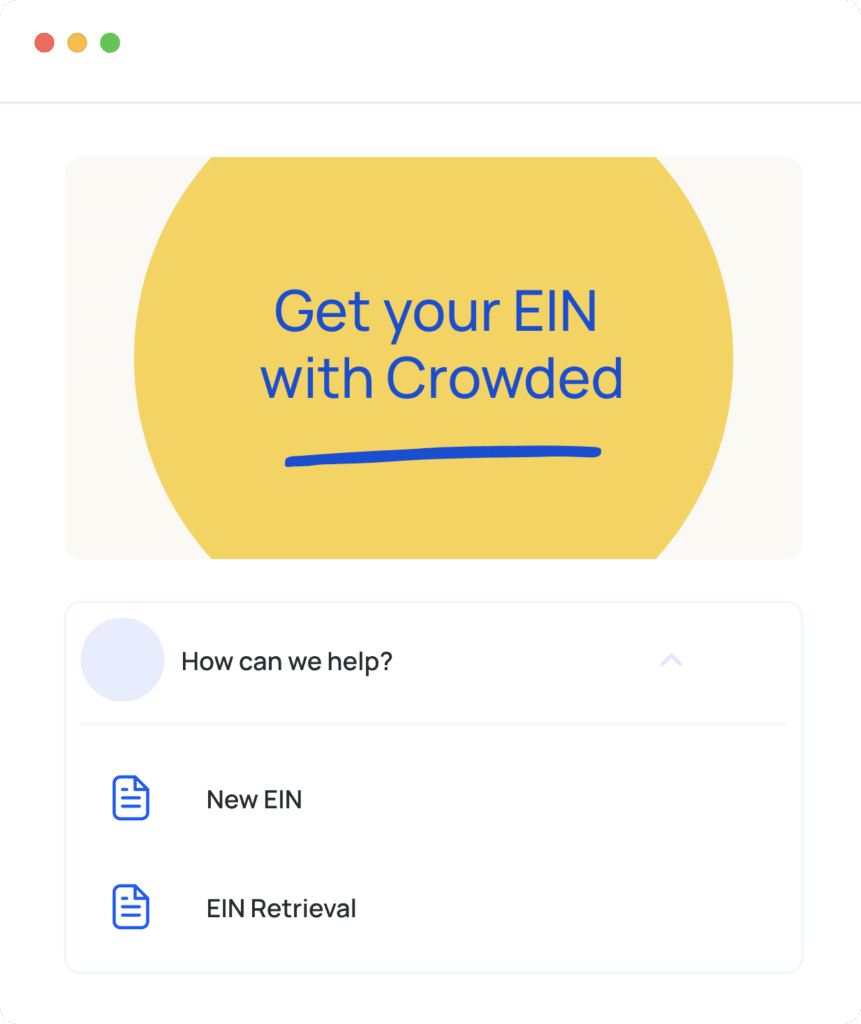

employer identification number

Get an EIN for your nonprofit

- Crowded will apply to the IRS on your behalf for an EIN.

- If your nonprofit has lost its EIN, we can retrieve it!

- Cheapest EIN service on the market: $20

Incorporation

Incorporation services for new nonprofits

- Formal incorporation of your nonprofit and certificate filed with the state.

- Free registered agent services.

- Child entities of parent organizations incorporate for free!

- Retrieval services of lost incorporation documentation

Creating a new nonprofit with Crowded:

Open a Crowded Account

Sign up for a free nonprofit bank account* with Crowded with basic info about your organization.

Get an EIN

Complete the order form within 2 minutes and expect your EIN in one business day.

Incorporate with Crowded

Just provide a name and standard information about your nonprofit and we’ll handle the rest of the incorporation.

Compliance resources for nonprofits:

Manage donations with confidence using our free IRS-compliant 501(c)(3) receipt template. Designed for enterprise nonprofits, it streamlines acknowledgments across multiple chapters and programs. Ensure audit readiness, maintain compliance, and strengthen trust with donors and funders.

When your nonprofit changes leadership or address, filing IRS Form 8822B is essential to avoid missed notices, delayed refunds, and compliance headaches. This guide breaks down exactly who needs to file, when to file, and how to complete the form with minimal stress. Plus, discover how Crowded helps multi-program and multi-chapter nonprofits stay IRS-ready every step of the way.

Managing IRS Form 990 compliance across chapters and complex programs? This guide breaks down instructions for large nonprofits—and includes a free IRS-compliant donation receipt template to keep you audit-ready.

answered.

Want to chat? Contact us.

What's the price for Crowded's EIN and incorporation services?

We are proud to say that we have the lowest prices on the market!

EIN:

New nonprofits/retrieval – $20

Incorporation:

New nonprofits- $95

Retrieval – $25

Child entities – free!

Why should my nonprofit use Crowded for the 990 Form filing?

Crowded is the only certified IRS e-filer that pre-fills fields on the 990 Form for nonprofits, making the process smooth and easy.

What if my nonprofit has not filed a Form 990 in previous years?

If your nonprofit has not filed a Form 990 for more than 3 consecutive years, your tax-exempt status may have been revoked. Crowded can reapply for nonprofit status on your behalf.

If your nonprofit has not filed a Form 990 in the past two years (2021-2023), Crowded can file those Form 990s.

Do I need an EIN to access Crowded's banking*?

If you would like to open a Crowded banking* account, you will need an EIN. If your nonprofit currently does not have one or needs help locating or updating your EIN, you can apply for one in our platform.

Is Crowded free?

Crowded accounts are free to set up – we have no minimum balances or subscription fees.

What do we charge for?

When collecting payments, we charge a small percentage of the collection amount, and our compliance services incur a small fee. See our full fee schedule here.

You can always choose whether you want to cover these fees or ask your payers to handle them.

Ready to make compliance a non-issue for your nonprofit?

Open a Crowded account today, whether you are a new nonprofit looking to get set up, or an existing one wanting compliant nonprofit banking!