If your nonprofit accepts grants, donations, or sponsorships, you’re probably managing restricted funds—whether you realize it or not. Mismanaging them can risk donor trust, IRS compliance, and future funding. This guide breaks down everything you need to know about restricted vs. unrestricted funds, with a free reporting template to help you track and report usage with clarity and confidence.

All Articles

- Date:

- Read time: 4 min

Manage donations with confidence using our free IRS-compliant 501(c)(3) receipt template. Designed for enterprise nonprofits, it streamlines acknowledgments across multiple chapters and programs. Ensure audit readiness, maintain compliance, and strengthen trust with donors and funders.

- Date:

- Read time: 4 min

When your nonprofit changes leadership or address, filing IRS Form 8822B is essential to avoid missed notices, delayed refunds, and compliance headaches. This guide breaks down exactly who needs to file, when to file, and how to complete the form with minimal stress. Plus, discover how Crowded helps multi-program and multi-chapter nonprofits stay IRS-ready every step of the way.

- Date:

- Read time: 4 min

Managing IRS Form 990 compliance across chapters and complex programs? This guide breaks down instructions for large nonprofits—and includes a free IRS-compliant donation receipt template to keep you audit-ready.

- Date:

- Read time: 4 min

Your funds deserve more than $250K in protection. With Crowded’s new FDIC-insured deposit sweep program, nonprofit users now get up to $3 million in automatic coverage—no extra steps, no extra accounts. This blog breaks down how sweep networks work, why they matter (especially in today’s banking climate), and how Crowded keeps your deposits safe, secure, and fully visible from one dashboard.

- Date:

- Read time: 4 min

SBA loans are often seen as a lifeline for small businesses—but can nonprofits qualify? In most cases, the answer is no. Traditional SBA programs like 7(a) and 504 exclude 501(c)(3) organizations, but there are exceptions for certain nonprofit childcare centers, community development corporations (CDCs), and for-profit subsidiaries. This guide breaks down exactly when nonprofits might be eligible, why most are not, and what alternative funding options exist.

- Date:

- Read time: 4 min

- Date:

- Read time: 4 min

Devastating floods have swept through Central Texas, claiming lives and displacing hundreds. Crowded’s Texas Flood Relief Campaign sends 100% of donations directly to vetted frontline organizations. Learn how you can help restore hope—fast.

- Date:

- Read time: 4 min

Numbers alone don’t inspire action—stories do. Learn how to turn financial data into compelling narratives that build donor trust and board confidence, using five practical storytelling techniques tailored for nonprofit boards.

- Date:

- Read time: 4 min

Looking for art grant proposal examples that actually get funded? This guide breaks down what to include, offers real artist proposal samples, and gives you free templates and creative project ideas—plus tips to stay organized with Crowded so you’re always grant-ready.

- Date:

- Read time: 4 min

Need funding for your team or athletic goals? This guide shows you how to write a winning sports sponsorship letter—plus free templates and real examples to get you started. Perfect for youth teams, clubs, and individual athletes looking to secure local support and streamline collections with Crowded.

- Date:

- Read time: 4 min

Running a youth sports team or school league? Skip the paper forms and payment chaos. Our free team registration form template helps you collect player info and track payments—fast, organized, and fully online. Perfect for volunteer coaches, team managers, and admins who want a smoother season.

- Date:

- Read time: 4 min

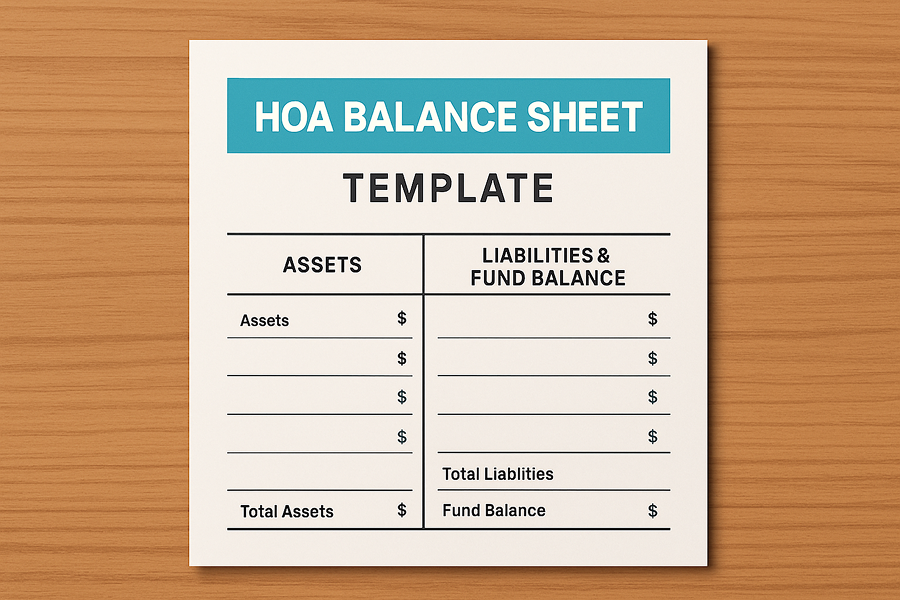

Get a clear view of your community’s finances with our free HOA balance sheet template. Track assets, liabilities, and reserves in one organized place—perfect for volunteer boards and self-managed HOAs. Pair it with Crowded to collect dues, pay vendors, and manage funds with full transparency. Built for compliance, clarity, and control.