The Problem: 41 Chapters, 41 EINs- and Chaos

NPMA had a common but costly problem: each of its 41 chapters operated as a separate legal entity with its own EIN and bank account. That meant:

Volunteer turnover = frozen bank accounts

Missing paperwork = inaccessible funds

No oversight = compliance risk and insurance gaps

Worse, NPMA’s national office had no legal authority to step in when chapters went quiet. One chapter had $8,000 locked away—untouchable because officers had disappeared. Every chapter was left to manage insurance, compliance, and registration alone without EIN consolidation.

NPMA had spent years searching for a solution that preserved local autonomy while protecting the entire organization. Nothing worked—until Crowded.

We had to rent a car and drive two hours to update bank signers. Then the bank canceled. That’s the kind of logistical nightmare we were dealing with before Crowded.

-Jen, Executive Director

The Solution: EIN Consolidation, Full Visibility

Visibility For the National Level

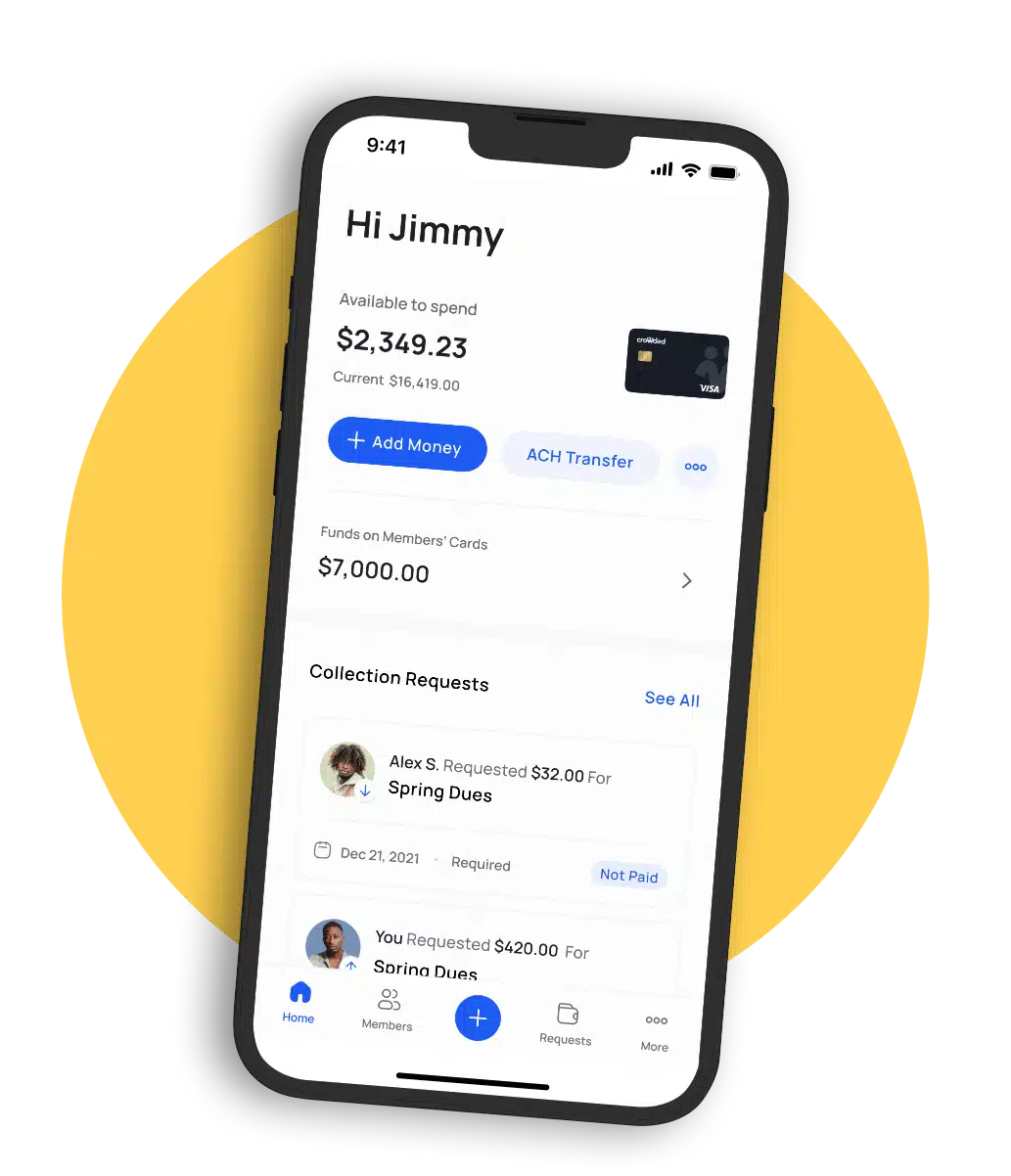

All 41 chapters now operate under NPMA’s national EIN, each with their own dedicated subaccount on Crowded. Funds are still chapter-owned and managed—but everything’s unified and visible.

Chapter Freedom, National Safeguards

Chapters continue to manage budgets and spending. But if a chapter goes dormant or leaders go MIA, the national office can step in—no funds get lost.

Seamless Volunteer Onboarding

Previously, updating signers meant hours of in-person coordination at local banks. With Crowded, NPMA can quickly assign or reassign chapter admins digitally—no paperwork, branch visits, or delays required.

Built-In Insurance and Compliance

Because all chapters now operate under the national EIN, they’re covered under NPMA’s liability insurance—removing the need for individual policies. Chapters also avoid the burden of registering separately with state or local governments, saving time and money.

Streamlined Payments and Reimbursements

With Crowded debit cards, chapters can pay vendors and members directly from their subaccounts—no need for checks, ACHs, or personal reimbursements. NPMA leadership can track spending in real-time and issue funds instantly when needed.

Why the Switch to One EIN Mattered

For NPMA, consolidating to one EIN wasn’t just about efficiency—it was about compliance, risk mitigation, and support. Without the EIN transition, chapters would be responsible for:

- Registering with state and local governments

- Hiring registered agents

- Obtaining their own insurance

Those requirements proved too costly and complex for many chapters, especially smaller ones. By consolidating under NPMA and adopting Crowded, nearly all chapters opted in—and avoided the administrative and financial burden of operating as standalone legal entities.

The insurance is expensive, and registering with the state and getting a registered agent isn’t easy either. By coming under our EIN, chapters avoid all that. It’s not about control—we’re making sure everyone’s protected, while still letting them manage their money

-Jen, Executive Director

The Best Financial Model for Multi-chapter Associations

NPMA’s rollout represents a textbook example of how associations can modernize financial operations while keeping chapter leaders engaged. By consolidating EINs, adopting Crowded subaccounts, and emphasizing member protection over control, they achieved near-universal adoption.

NPMA saves up to $325,000 and 160 hours a year

since switching to Crowded

loss or inaccessibility

on signer updates alone